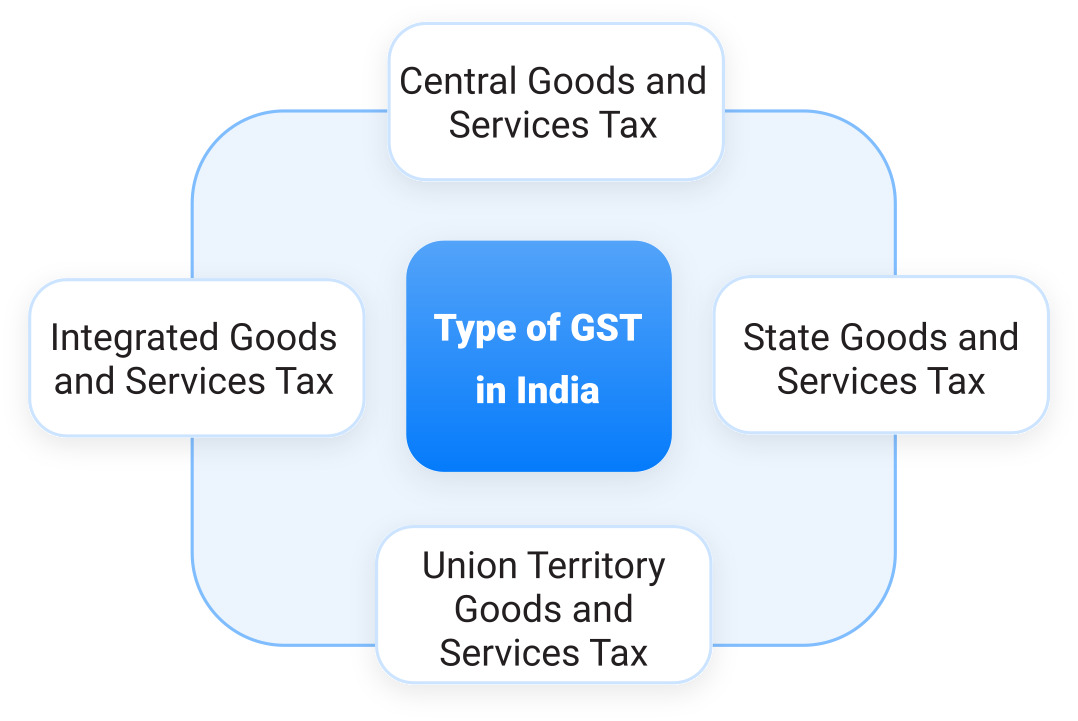

GST Registration Online

GST Application Filing in Just 2 Business Days.

Experience a seamless GST registration process — from application tracking to resolving clarifications with authorities.

Tailored GST services for businesses, eCommerce sellers, startups, and government offices.

Comprehensive GST services, including CA-assisted online document submission, GST return filing, and GSTIN procurement.

Expert assistance for GST e-invoicing, ledger management, and invoice maintenance to ensure compliance.